Case Study

Give your clients the well-rounded range of coverage options they need with Chubb

By offering complementary specialized products and services to your middle market clients, you can provide continuity of coverage. You can also:

What's more, when you work with Chubb, you'll have access to experienced specialized underwriters who will evaluate the full range of risks that merit coverage and deliver the kind of industry expertise your clients can benefit from.

As Environmental Pollution Liability Leader, Amanda Braz knows how a pollution incident can have serious consequences for manufacturers. To overcome this, she recommends Environmental – Pollution Liability, an essential coverage in these instances.

Your clients may not be aware of the sheer range of exposures that our Employment Practices Liability covers. Kristen Poplar, EPL Leader, reviews them.

Mike Williams, Manufacturing Industry Practice Leader, shares insights into how significantly and quickly manufacturing risks are evolving.

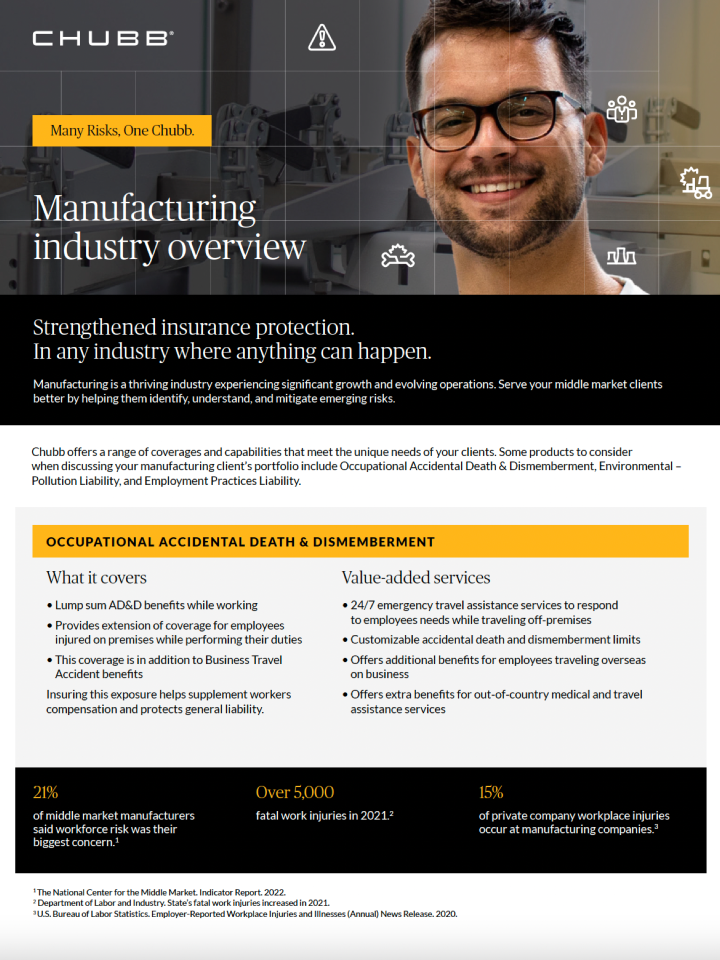

We meet manufacturers' many risks with a suite of coverage options.

Here are three product offerings and coordinating services to engage with your clients about surrounding potential gaps in their coverage.

Last year, 21% of manufacturers said workforce risk was their biggest concern. 1

Case Study

Appetite Grid

Educational Risk Blog

Access our sales tools

A well-rounded insurance solution can help clients manage and mitigate the risks associated with their operations. See how Chubb can help clients manage risk to protect them from losses, meet legal requirements, and enhance their reputation and stability.

Download our Industry Overview, Talking Points, and Case Study.

Many Risks, One Chubb: Growing Business in the Technology, Manufacturing and Professional Services Industries

Your clients face a world of risks and exposures that they may not fully consider when making decisions about their organization. By introducing complementary products and services, you can help them recognize emerging risks, strengthen your existing relationship, and grow your book of business. However, a successful cross-sale doesn’t just happen, it takes a combination of knowledge, timing, and a team approach.

We’re here to help you succeed

For more information:

Agents and brokers: Login to @Chubb, contact your local underwriter, or click here to find your contact by region

Current Chubb clients: Contact your agent or broker

Become a client or get a quote: Find an agent

Become an appointed agent: Complete the application

1 The National Center for the Middle Market. Indicator Report. 2022.

2 USI. Commercial Property & Casualty Market Outlook: 2021 Mid-Year Update.

3 Equal Employment Opportunity Commission (EEOC). 2021.

Chubb is the marketing name used to refer to subsidiaries of Chubb Limited providing insurance and related services. For a list of these subsidiaries, please visit our website at www.chubb.com. Insurance provided by ACE American Insurance Company and its U.S.-based Chubb underwriting company affiliates. All products may not be available in all states. This communication contains product summaries only. Coverage is subject to the language of the policies as actually issued. Surplus lines insurance sold only through licensed surplus lines producers. Chubb, 202 Hall's Mill Road, Whitehouse Station, NJ 08889-1600.